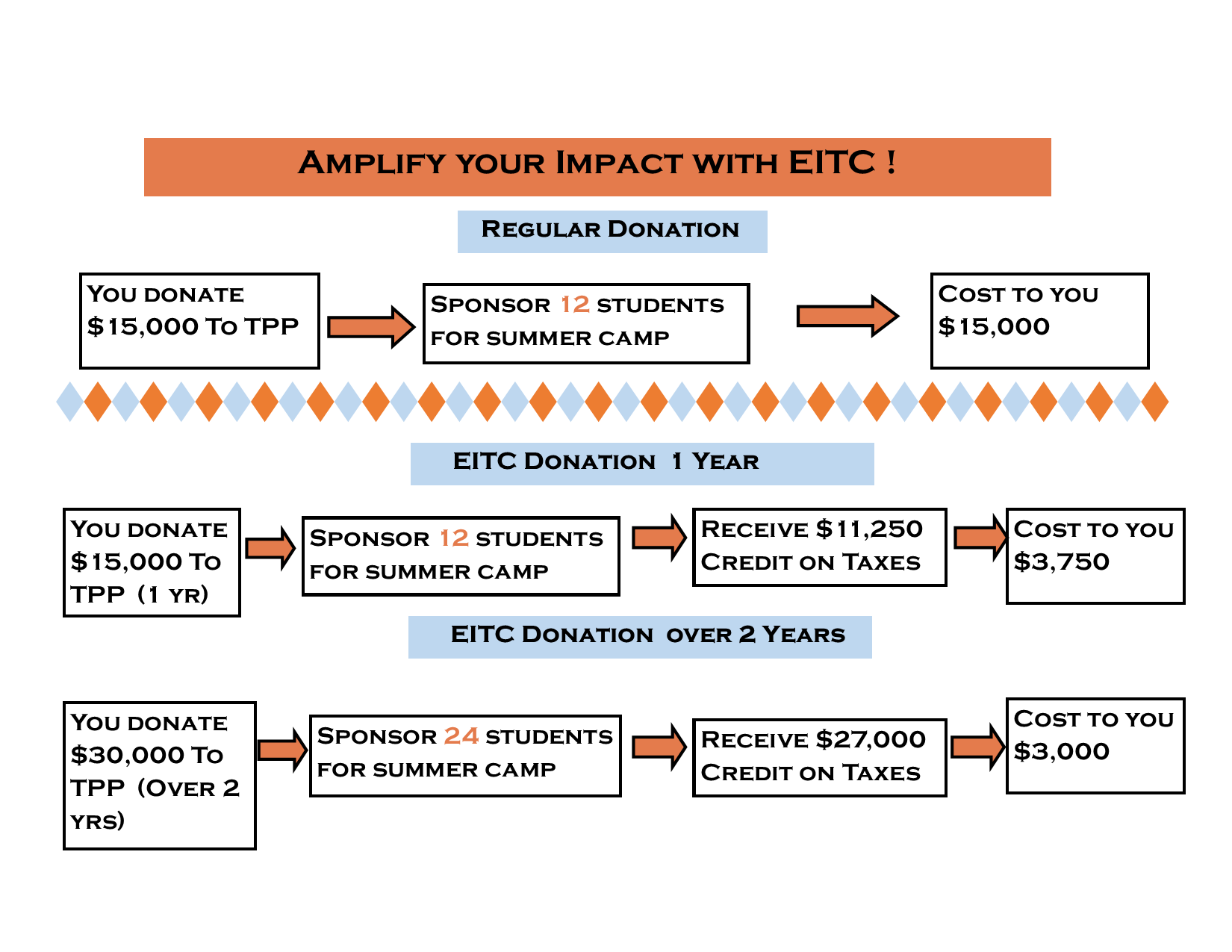

EITC A Win- Win!

PA’s Educational Improvement Tax Credit Program allows businesses to donate to approved Educational Improvement Organizations like TPP and receive tax credits. This program ensures that your PA taxes are benefitting your local community. Tax credits equal to 75% of the contribution up to a maximum of $750,000 per taxable year can be increased to 90% of the contribution if your business agrees to provide the same amount for two consecutive tax years.

How to Register with the Department of Communiy & Economic Development

Do you qualify?

Pennsylvania businesses or corporations can qualify if they pay any of the following taxes:

Corporate Net Income Tax

Capital Stock Franchise Tax

Bank and Trust Company Shares Tax

Title Insurance Companies Shares Tax

Insurance Premiums Tax

Mutual Thrift Institution Tax

Insurance Company Law of 1921

Personal Income Tax of S corporation shareholders or Partnership partners

2. Apply with DCED

Apply here

Specific Instructions for applying click here

May 16 – Business applicants who have fulfilled their 2-year commitment and wish to reapply to renew their 2-year commitment.

May 16 – Businesses who are in the middle of their 2-year commitment.

July 1 – All other businesses including initial applicants and those applicants wishing to submit an additional application on top of their previously submitted 2-year commitment.

There is a limited amount of tax credits, so apply early!

3. Make your donation to TPP

Once your application has been approved by DCED, your business must contribute to TPP within 60 days.

You need to send proof of the contribution to DCED within 90 days of the approval.